Filing your Beneficial Ownership Information (BOI) is an important compliance step for many businesses under the Corporate Transparency Act. This process ensures transparency in ownership and helps prevent illegal activities like money laundering. In this guide, we’ll walk you through each step of the BOI filing process online, so you can meet regulatory requirements quickly and accurately.

Step 1: Collect Required Information from Beneficial Owners

Gather the necessary information from each beneficial owner and company applicant (if applicable), including their name, date of birth, address, a unique ID number from an accepted identification document, and the issuing jurisdiction of that document. (Alternatively, if the individual has a FinCEN ID, that may be used instead.) Ensure this information is ready before starting the BOIR web filing, as it must be completed and submitted in real-time without the option to save and return later.

Step 2: Gather Required Documents

Obtain a clear, electronic image of an acceptable identification document for each company applicant and beneficial owner, unless they have a FinCEN ID. Acceptable documents include a state-issued driver’s license, state/local/tribal ID, U.S. passport, or, if none of these are available, a foreign passport.

The image must be complete, clear, and legible, showing the unique identifying number and other relevant details. Supported file formats are JPG/JPEG, PNG, and PDF, with a maximum file size of 4 MB per image.

Step 3: Navigate to the BOI Report E-Filing Application

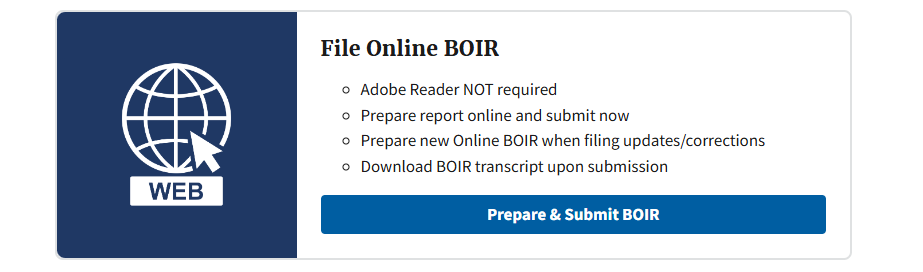

You can access the BOIR E-Filing application home page (https://boiefiling.fincen.gov/fileboir) from any personal computer or mobile device with internet access. Select “Prepare & Submit BOIR” under the “File Online BOIR” option to start your Online BOIR.

Step 4: Complete the Online BOI Report

Select each section tab to enter the additional required information, and attach images of acceptable identification documents for beneficial owners or company applicants as prompted.

Filing Information

Select the type of BOI report you are filing. If this is your first time filing, select “Initial report”. If you need to issue a correction on a prior report, select “Correct prior report”. If your beneficial ownership information has changed since you last filed the report, select “Update prior report”.

Reporting Company

Reporting company information is entered in fields 3 through 16 of the BOIR.

Instructions for Item 3 – Request for FinCEN Identifier (FinCEN ID):

Check this box if you wish to receive a unique FinCEN Identifier for the reporting company. This identifier will be included in the confirmation details provided after the BOIR submission is accepted.

Instructions for Item 4 – Foreign Pooled Investment Vehicle:

Select this box if the reporting company is a foreign pooled investment vehicle that must report information per 31 CFR 1010.380(b)(2)(iii).

Company Applicant

Only individuals, not companies or legal entities, can be listed as company applicants. Alternatively, reporting companies may use FinCEN Identifiers for company applicants in place of this information.

Use the “Add Company Applicant” or “Remove Company Applicant” buttons at the top of this section to manage company applicants, with a maximum of two applicants allowed. If you selected “existing reporting company” in item 16, company applicant information is not required—proceed directly to the next part.

Beneficial Owners

Beneficial owner information should be entered in fields 35 through 51 of the BOIR. Alternatively, reporting companies can use a FinCEN Identifier for a beneficial owner in place of providing this information.

Submit the Online BOI Report

The Online BOIR is ready for submission once you’ve completed all required fields. In the ‘Submission’ section, enter your name and email address, complete the certification, and then click ‘Submit Online BOIR.’

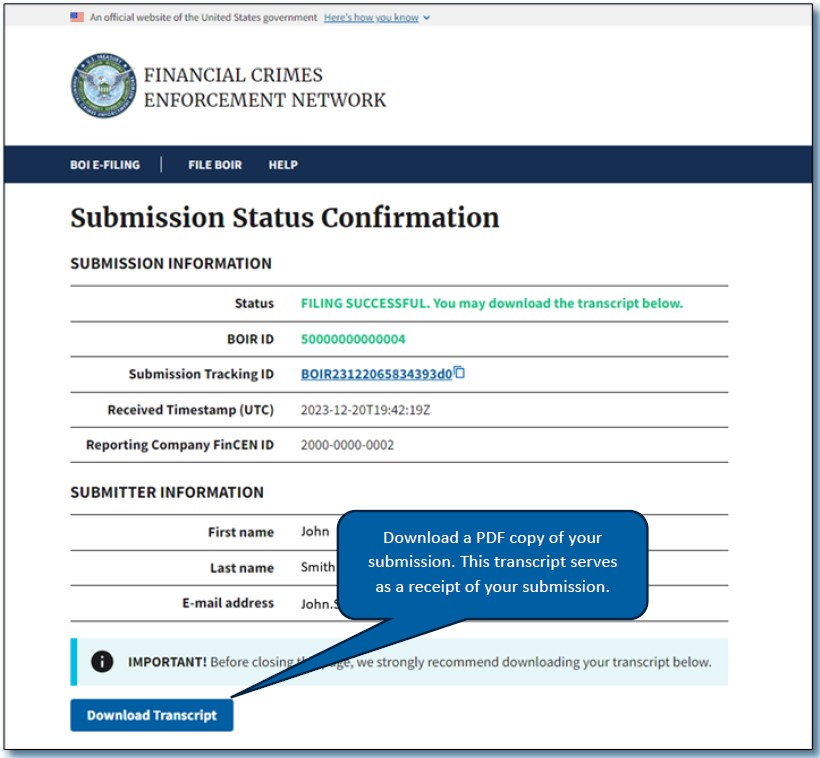

Submission Confirmation

Once you click ‘Submit Online BOIR,’ a submission status screen will appear. From this page, you can download a copy of your BOIR filing.